Nursing and Taxes in Canada – Banking OT vs Paying it out EXPLAINED 2021

Hi Everyone,

In this video, I will talking about taxes applied to nursing salaries in Canada. This will hopefully, clarify why some nurses choose to bank their overtime shifts or to get paid out on them and I also hope to provide a bit of general knowledge about how taxes work in Canada.

In this channel I talk about all aspects of nursing from pre-nursing to post graduate programs. If you want to learn more about nursing consider subscribing and giving this video a thumbs up, I would greatly appreciate that. I also have a free 45 day NCLEX guide on my website www.simplefitnurse.com that you can download.

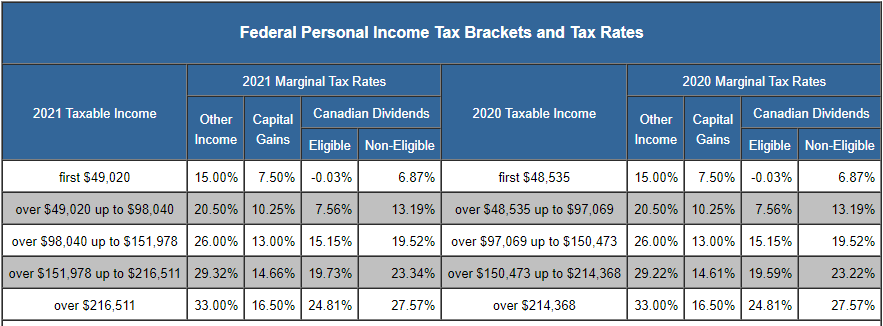

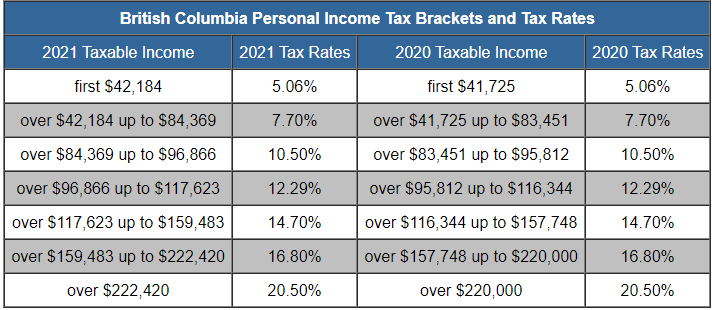

Alright so let’s talk about taxes in Canada and how it works. I wanted to make this video in particular because I think it is important to understand how money works especially since we work so hard for each dollar we earn. In Canada income tax is one of the most heavily taxed incomes and each province has a different tax rate that you must pay. In addition to the provincial tax rate, each person must also pay a standardized federal tax rate. The rate of tax is based on your total income. However it is a little bit more complicated than that and this is where most people get confused, I’ll explain. First let me show the tax brackets for 2020 and 2021.

Here are the federal tax brackets in Canada in 2020 and 2021:

And here are the provincial tax brackets in British Columbia for 2020 and 2021:

If you live in a different province click the link in the description box down below to find your tax bracket based on the province you live in.

To give you a higher level understanding, let’s consider you make 90,000 dollars a year in the province of British Columbia in 2021. The total tax that I would pay on the 90,000 dollars would be the following

- 5.06% on the first 42,184 dollars due to the provincial tax rate

- 15% on the first 49,020 dollars due to the federal tax rate

- Then I would pay an additional

- 7.7% on the remaining (84,369 – 42,184 = 42,185) due to the provincial tax rate and

- 20.5% on the remaining (90,000 – 49,020 = 40,980) due to the federal tax rate

- And then I would pay an additional 10.5% on the remaining (90000 – 84,369) = 5631 due to provincial tax rate.

So to put it more clearly, this is the break down of how much I would pay for provincial tax in B.C in 2021:

5.06 % on 42,184 = (42,184 * 0.0506) = 2,134.5104

7.7% on 42,185 = (42,185 * 0.077) = 3,248.245

10.5% on 5631 = (5631 * 0.105) = 591.255

Total provincial tax paid: 2,134.5104 + 3,248.245 + 591.255 = 5,974.0104

42,184 + 42,185 + 5631 = 90000

And this is the breakdown of how much I would pay for federal tax in 2021:

15% on 49,020 = (49020 * 0.15) = 7353.0

20% on 40,980 = (40,980 * 0.20) = 8196

Total federal tax paid: 7353 + 8196 = 15549

So as you can see, the more money you make, the higher tax bracket you get placed into meaning you will pay more tax. But this is inevitable anyways, which means you should always aim to earn as much as you can.

Now, let’s talk about why some people “bank OT” or have it “paid out”. So this is a concept that I failed to truly understand and there is a misconception about this that if you make more money you will pay more, there actually is some truth to that but it is complicated. So let’s say you make a lot on one pay cheque, the way hospital works, is it will automatically reduce your taxes from your paycheque depending on how big it is. That means that if you properly adjust by banking and paying out, you can maximize the money you get. But in the end year, it does not matter because you will get the taxes paid back if you paid more. So the point of doing this is you get that money right away rather than having it paid back to you at the end of the year. So essentially you are trying to avoid paying more tax on your pay cheque by banking OT. However, like i said this does not matter in the end as you will calculate your taxes and receive either money back or have to pay it according to the appropriate bracket you are in. This is an especially important point to make as nurses work usually 4 shifts in a row with 5 days off, so that means some months you may have a proportionately smaller or larger pay cheque depending on how the schedule is adjusted to be.

Hopefully this clears up questions about the banking OT phenomenon and why people do it. I hope you enjoyed this video, if you did please give the video a thumbs up and subscribe for more content like this. Thank you and I will catch you guys in the next video!

An impressive share! I’ve just forwarded this onto a

friend who had been doing a little homework on this. And he in fact bought me dinner because I

stumbled upon it for him… lol. So allow me to reword this….

Thanks for the meal!! But yeah, thanx for spending some time to talk about this matter here on your website.

I visited multiple sites but the audio feature for audio songs current at this

website is in fact wonderful.

Howdy! I just would like to give you a big thumbs up for the great info you have got here on this post.

I will be returning to your site for more soon.

Hello there! I just wish to offer you a big thumbs up for the great information you have

here on this post. I will be returning to your website for more soon.